jl mag rare-earth industry price briefing 11-22~11-26

week 48,2021

1. 重要新闻简报briefing of important news

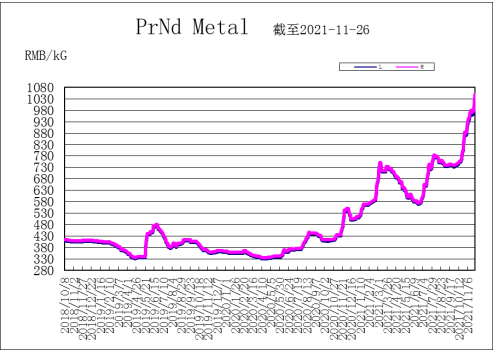

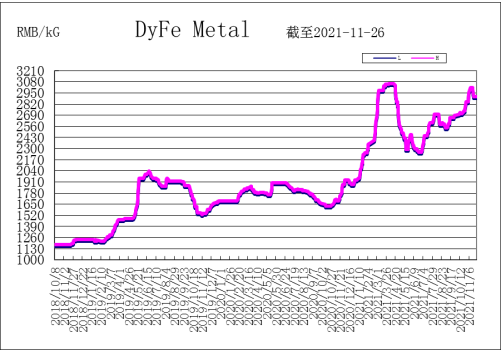

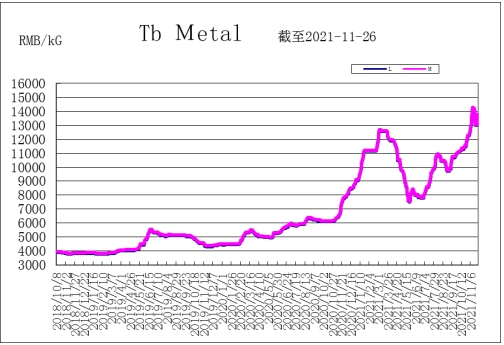

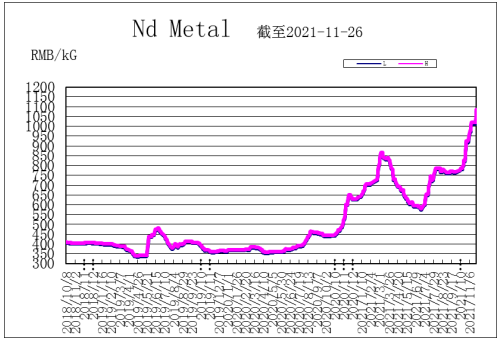

本周稀土市场行情,镨钕、金属钕和铽的价格小幅上涨,镝铁的价格较为稳定。亚洲金属网周末价格: 镨钕金属价格1040-1050元/kg;金属钕价格1075-1085元/kg;镝铁合金价格2890-2910元/kg;金属铽价格13750-13800元/kg。

this week, prices of prnd, nd metal and tb rose slightly, price of dyfe was relatively stable. prices from asian metal at this weekend presented: prnd metal 1,040-1,050 rmb/kg; nd metal 1,075-1,085 rmb/kg; dyfe alloy 2,890-2,910 rmb/kg; and tb metal 13,750-13,800 rmb/kg.

工信部、市场监管总局印发《电机能效提升计划(2021-2023年)》提出,到2023年,高效节能电机年产量达到1.7亿千瓦,在役高效节能电机占比达到20%以上,实现年节电量490亿千瓦时,相当于年节约标准煤1500万吨,减排二氧化碳2800万吨。推广应用一批关键核心材料、部件和工艺技术装备,形成一批骨干优势制造企业,促进电机产业高质量发展。引导企业实施电机等重点用能设备更新升级,优先选用高效节能电机,加快淘汰不符合现行国家能效标准要求的落后低效电机。(财联社)

the ministry of industry and information technology and the state administration of market supervision issued the "motor energy efficiency improvement plan (2021-2023)" and proposed that by 2023, the annual output of high-efficiency and energy-saving motors will reach 170 million kw, accounting for more than 20% of the in-service high-efficiency and energy-saving motors, realizing an annual power saving of 49 billion kwh, equivalent to an annual saving of about 15 million tons of standard coal and a reduction of 28 million tons of carbon dioxide. promote the application of a batch of key core materials, components and process technology equipment, form a batch of backbone manufacturing enterprises, and promote the high-quality development of the motor industry. guide enterprises to implement updates and upgrades of key energy-consuming equipment such as motors, give priority to high-efficiency and energy-saving motors, and accelerate the elimination of backward and low-efficiency motors that do not meet the requirements of current national energy efficiency standards. (associated finance press)

2. 业内人士分析analysis of professional insiders

本周稀土市场上行走势愈发明显,轻重稀土的走势整体一致,但细微处略有不同,镨钕产品周初延续上周的涨势出现平稳至暴涨,随着价位快速拉升及下游短暂恐慌造成高位成交后,镨钕价格趋于冷静。重稀土镝铽在弱稳中不断回调、试探,伴随镨钕涨价也稳固提升。

the upward trend of the rare earth market has become more and more obvious this week. the overall trend of light and heavy rare earths is the same, but the subtleties are slightly different. at the beginning of the week, prnd products continued the upward trend of last week and stabilized to skyrocketing. with the rapid rise of price and the high transaction caused by the short panic in the downstream, the price of prnd tended to calm down. the heavy rare earth dy and tb continued to callback and test in the weak stability, and the price of prnd also increased steadily.

本周镨钕产品暴涨的模式,出现的令人始料不及,在周二稀交所暂停挂牌的信息出来后,周三镨钕市场热度点爆,日涨幅7%,上游试探拉涨随着哄抬价格。同样,伴随镨钕的暴涨,镝铽也开始试探高报价频出,整体市场一度询单暴增。周末期,整体市场趋于冷静,持稳观望居多,多数贸易商及分离厂以不报价居多,出货意愿不强,金属厂的订单并未有预期的火爆,虽有询盘,但活跃度降低。整体来看,上游企业的看涨情绪仍在,但对上涨幅度有所保留,但面对如此高价位下的稀土价格,突破瓶颈或许有些难度。

prnd products soared this week, which was unexpected. after the news of the suspension of listing on the rare exchange stock market on tuesday, the prnd market became hotter on wednesday, with a daily increase of 7%. similarly, with the skyrocketing price of prnd, dy and tb also began to test the frequent occurrence of high quotations, and the overall market once soared inquiries. during the weekend period, the overall market tended to be calm, and mostly remained stable. most traders and separation plants did not offer quotations and were not willing to ship. metal factories’ orders were not as hot as expected. although there are inquiries, their activities are reduced. on the whole, the bullish sentiment of upstream companies is still, but they have reservations about the rate of increase. however, in the face of rare earth prices at such a high price, it may be difficult to break through the bottleneck.

后续预测:镨钕本周的暴涨,报价的追涨,导致部分厂家捂货行为异常明显,主流大厂在本轮波动中始终保持谨慎的稳价态度,目前轻重稀土均处于历史高位,且上下游的僵持与对峙仍很激烈。缅甸关口在本周仅开通木姐口岸,离子矿何时能进来各种传言较多。整体来看,需求支撑仍存在,这也决定了年末价格趋势向上的动因,但在如此高价下,集团的态度、下游对价格的接受或者高价向下传导的力度才会是价格落地的基础。(瑞道稀土资讯)

follow-up prediction: the rapid increase of prnd this week and the chasing increase in quotations have caused some manufacturers to cover their goods. the mainstream manufacturers have always maintained a cautious and stable price attitude during this round of fluctuations. the current light and heavy rare earths are at historical highs and are rising, the stalemate and confrontation downstream are still fierce. the burmese border only opened the muse port this week. there are many rumors about when the ion mine will be able to enter. on the whole, demand support still exists, which also determines the motivation for the upward price trend at the end of the year. however, at such high prices, the group's attitude, downstream acceptance of prices, or the strength of the downward transmission of high prices will be the basis for price landing. (redo rare earth information)

南方稀土发布11月22日稀土氧化物挂牌价

listing price of rare earth oxides on november 22nd from china southern rare earth

单位:万元/吨(出厂含税价)

unit: 10 thousand rmb/ ton (exw price incl. tax)

产品目录 product list | 纯度 purity | 11月15日挂牌价 ember 15th | 11月22日挂牌价 listing price on november 22nd | 涨跌 rise/fall |

氧化钐 sm oxide | ≥99.5% | 1.4-1.45 | 2.5-2.55 | 1.1 |

氧化铕 eu oxide | ≥99.99% | 21-21.5 | 21-21.5 | 0 |

氧化钆 ga oxide | ≥99.5% | 38.5-39 | 38.5-39 | 0 |

氧化铽 tb oxide | ≥99.99% | 1120-1130 | 1040-1060 | -80 |

氧化镝 dy oxide | ≥99.5% | 295-300 | 290-295 | -5 |

氧化钬 ho oxide | ≥99.5% | 120-121 | 117-119 | -3 |

氧化铒 er oxide | ≥99.5% | 37-37.5 | 35-35.5 | -2 |

氧化镱 yb oxide | ≥99.99% | 13.5-14 | 13.5-14 | 0 |

氧化镥 lu oxide | ≥99.99% | 525-535 | 525-535 | 0 |

氧化钇 yt oxide | ≥99.999% | 6-6.2 | 6.1-6.3 | 0.1 |

氧化钪 sc oxide | ≥99.99% | 900-905 | 900-905 | 0 |

3. 趋势图(参考亚洲金属网)tendency chart (refer to asian metal)

2021年11月26日

november 26th, 2021

提示:以上信息仅供参考!

notes: the information above is for reference only!

language

language

現在の位置: > レアアース情報 > 業界情報速報

現在の位置: > レアアース情報 > 業界情報速報